Life Insurance Advisors

Case:

A life insurance agency with a growing client base faced delays in responding to inquiries, missed premium renewals, and inconsistent follow-ups that impacted conversion rates and policy retention.

Solution:

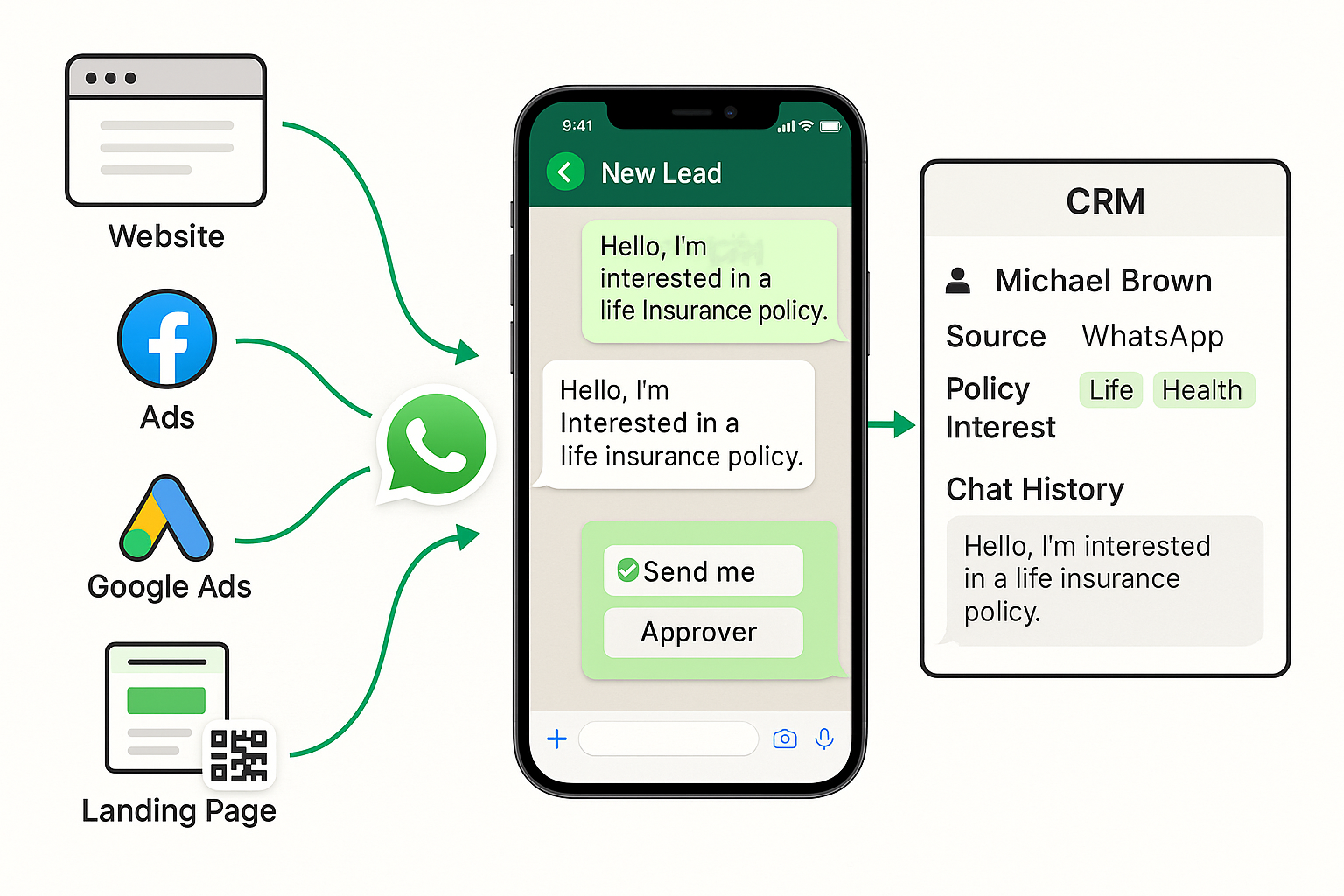

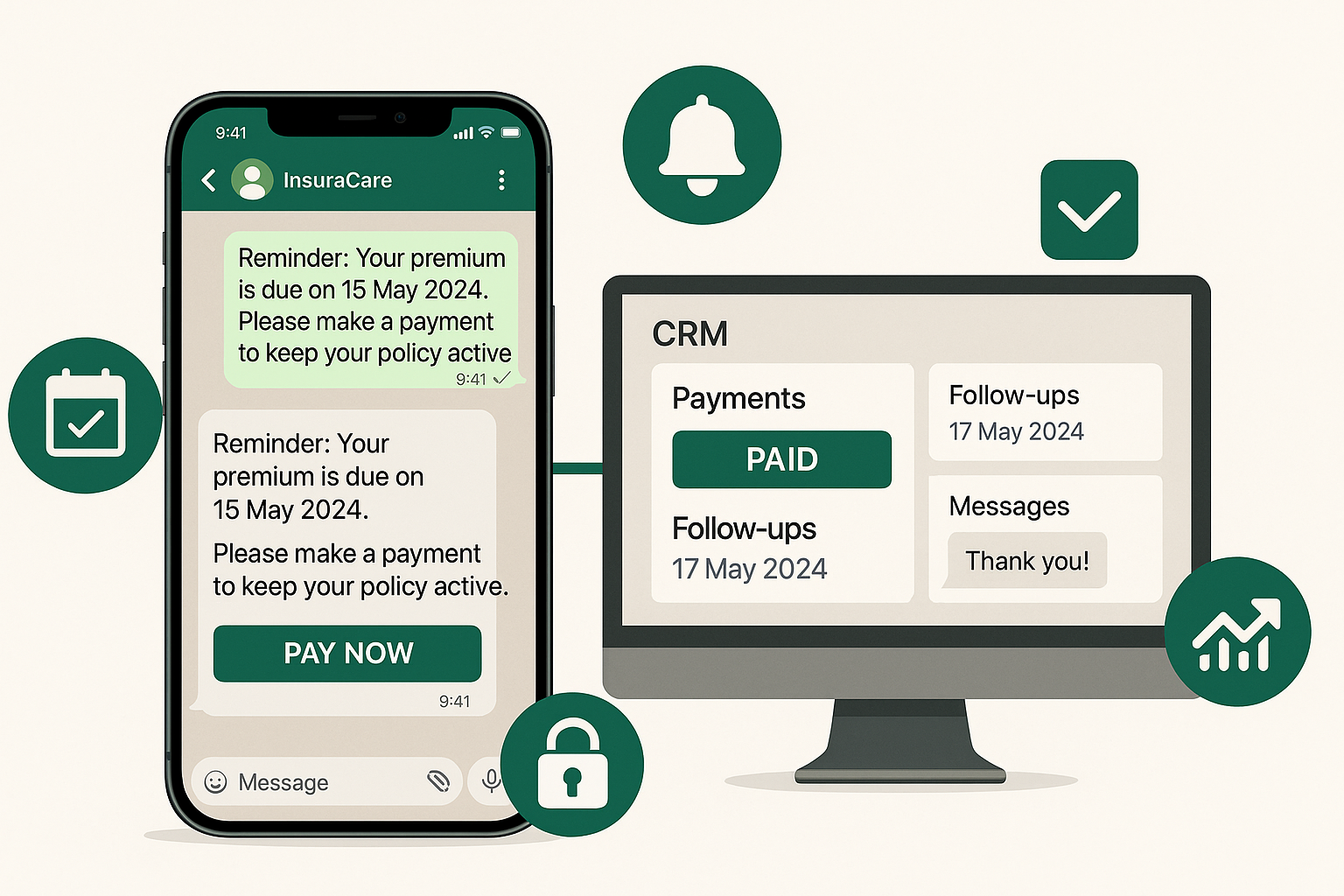

WhatZCRM enabled the agency to automate WhatsApp replies to new leads, share term plan options and benefit illustrations instantly, and send timely premium reminders. Every client interaction was logged and tracked within the WhatsApp CRM.

Result:

The insurance team achieved a 35% increase in policy conversions and saw a 50% drop in late payments using automated WhatsApp reminders. Real-time engagement led to faster decisions and improved customer satisfaction.

Health and General Insurance Brokers

Case:

A mid-sized insurance brokerage handling health, motor, and travel policies struggled with slow document collection, scattered claim communication, and delayed customer onboarding.

Solution:

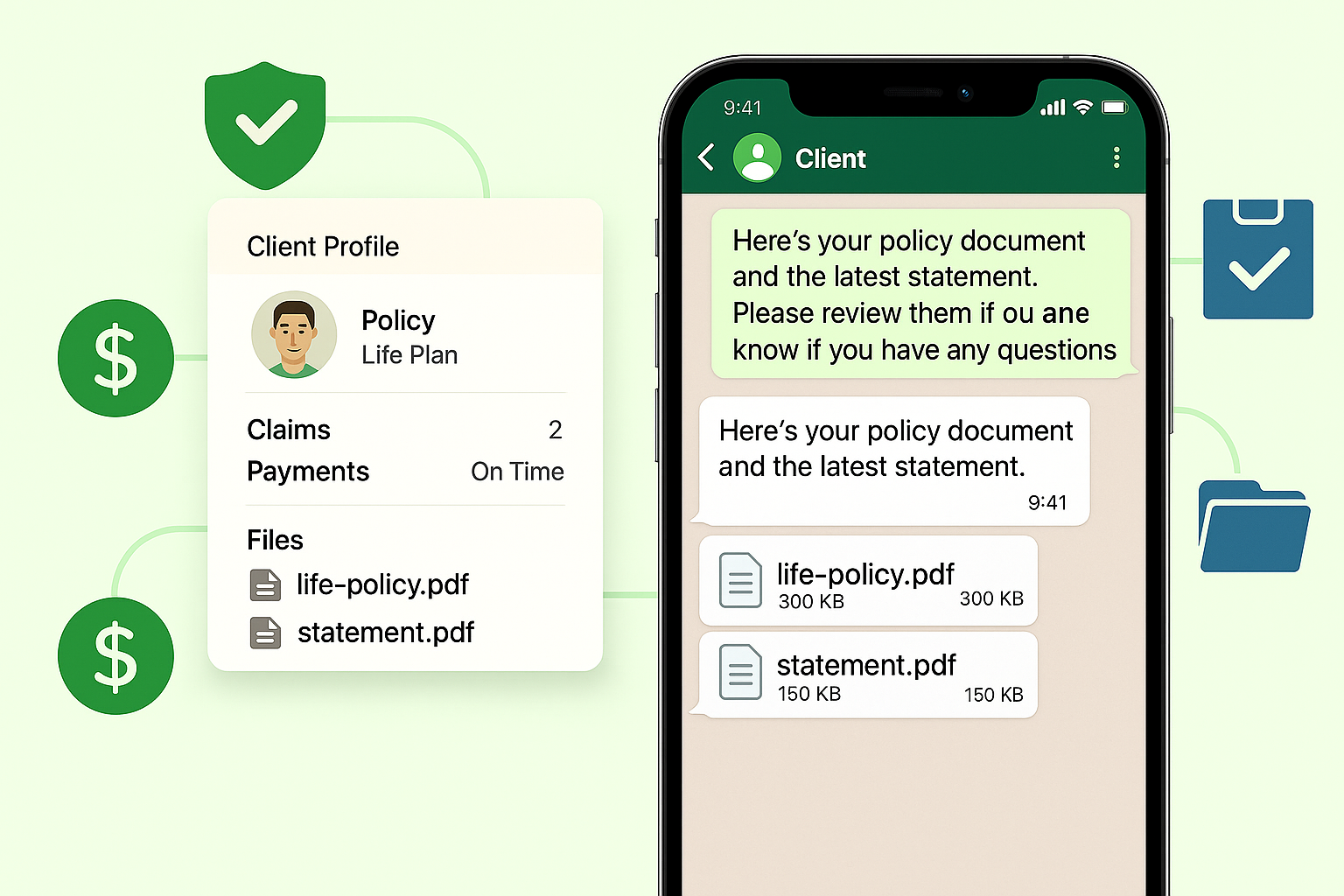

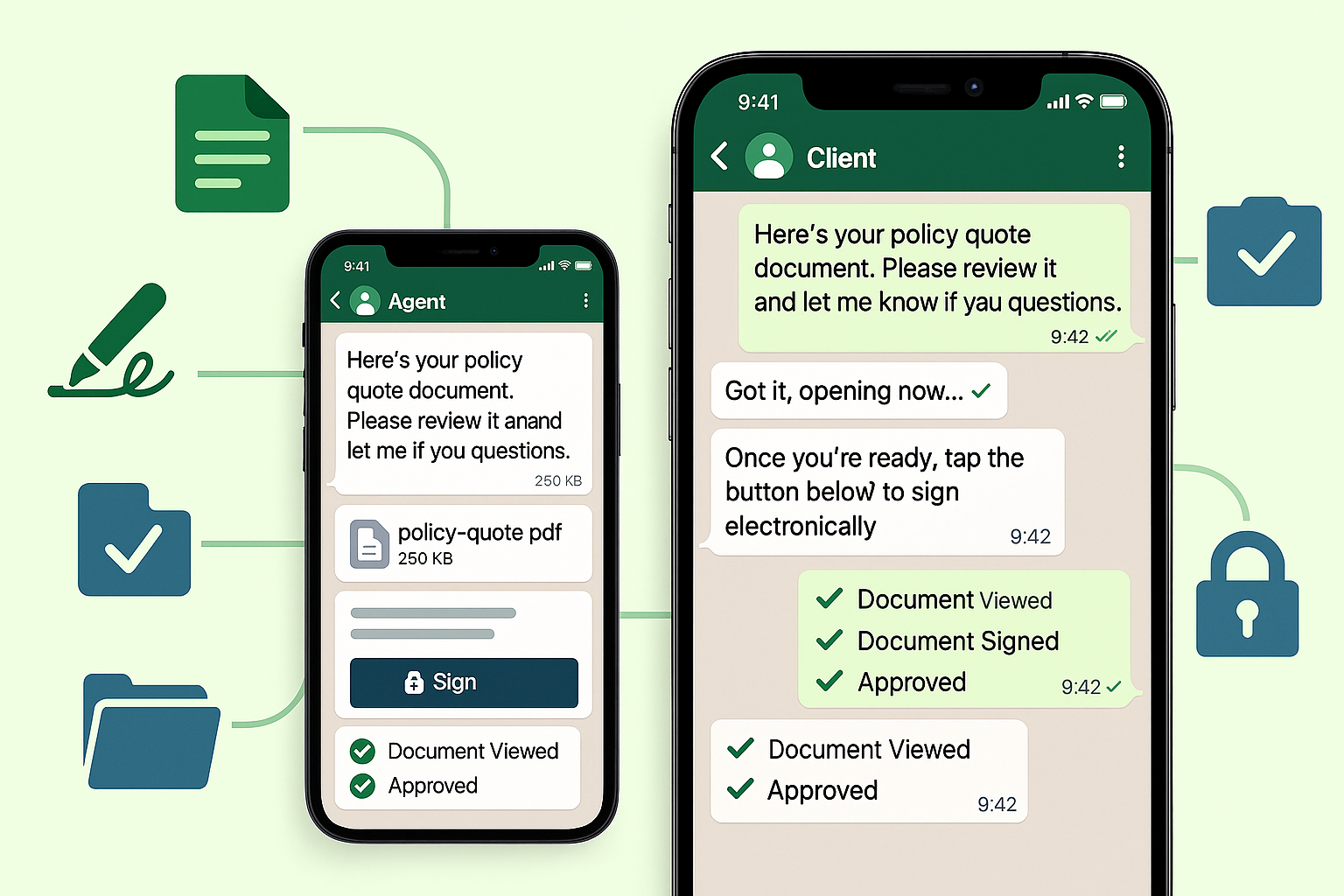

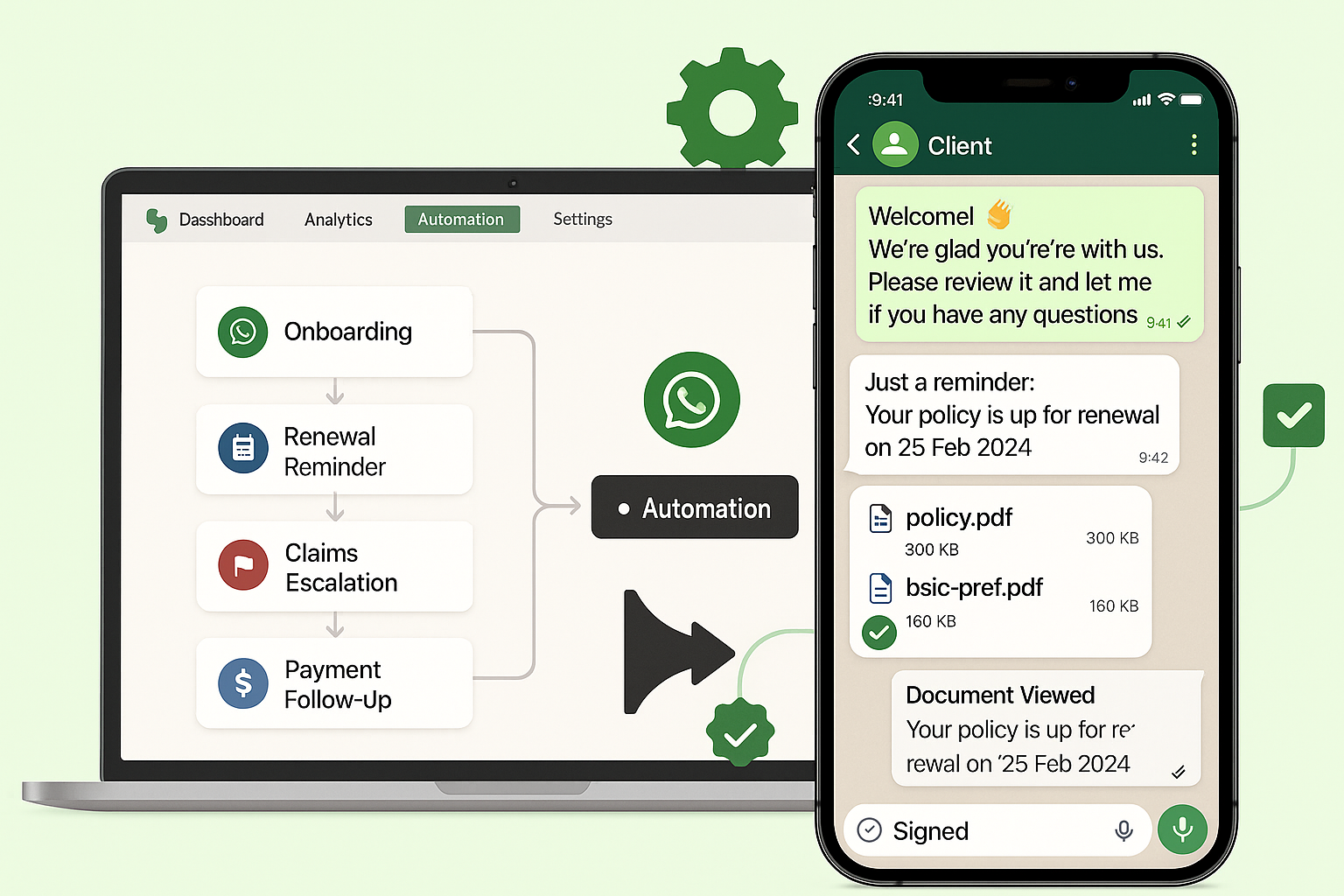

WhatZCRM enabled the brokerage to share brochures and collect KYC and policy documents, initiate claims, and onboard customers all via WhatsApp. Customers could upload documents and receive instant confirmation and next steps.

Result:

Insurance teams accelerated claim approvals by enabling real-time document uploads through WhatsApp. Automated workflows and centralized chat history helped save up to 40% of time spent on customer servicing and document handling.

TPAs and Support Teams

Case:

A Third Party Administrator (TPA) managing claim support for multiple insurers and hospital networks faced long resolution times and high call volumes from patients, HR departments, and healthcare providers.

Solution:

WhatZCRM helped the TPA automate claim query intake, eligibility verification, and real-time policy lookup via WhatsApp. Multilingual AI chatbots provided instant claim status updates and routed urgent requests to human agents when needed.

Result:

WhatZCRM enabled insurance teams to resolve support queries three times faster across departments. With 24/7 multilingual chatbot support, the overall workload on human agents was significantly reduced, ensuring quicker response times and improved customer experience.

Motor Insurance Aggregator

Case:

A vehicle insurance aggregator, handling thousands of car and bike policies, struggled with post-sale customer queries, missed renewal follow-ups, and manual claim intake, particularly during peak months.

Solution:

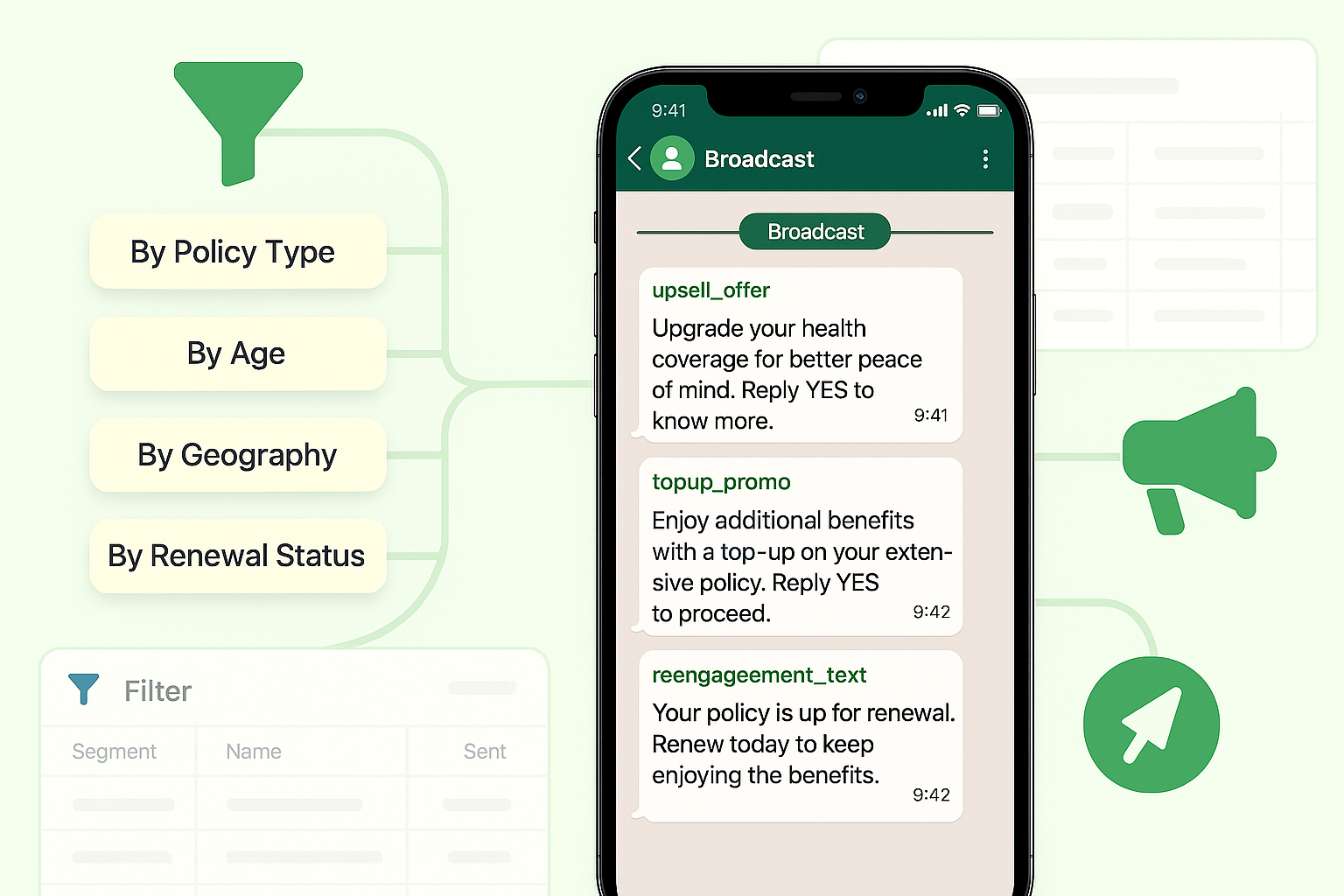

WhatZCRM enabled the team to automate policy renewal reminders with secure payment links, offer self-serve claim initiation via WhatsApp chatbot, and segment clients based on vehicle type and policy expiry dates.

Result:

With WhatsApp automation, insurance teams saw a 30% rise in on-time policy renewals and a 50% drop in incoming support calls. Streamlined workflows also led to twice as fast claim processing, improving both efficiency and customer satisfaction.

Microinsurance Provider

Case:

A microinsurance company offering low-cost health and accident coverage to rural and semi-urban areas struggled with educating policyholders, collecting documents, and ensuring renewal continuity without costly field agents.

Solution:

WhatZCRM enabled the provider to utilize multilingual WhatsApp bots for explaining policy benefits, collecting ID proof, and reminding clients of renewal dates. Field teams could also log visits and update statuses via WhatsApp.

Result:

Using multilingual WhatsApp automation, insurers reached five times more customers in local languages, leading to a 40% drop in lapsed policies. The platform also improved rural engagement without increasing field staff or operational costs.