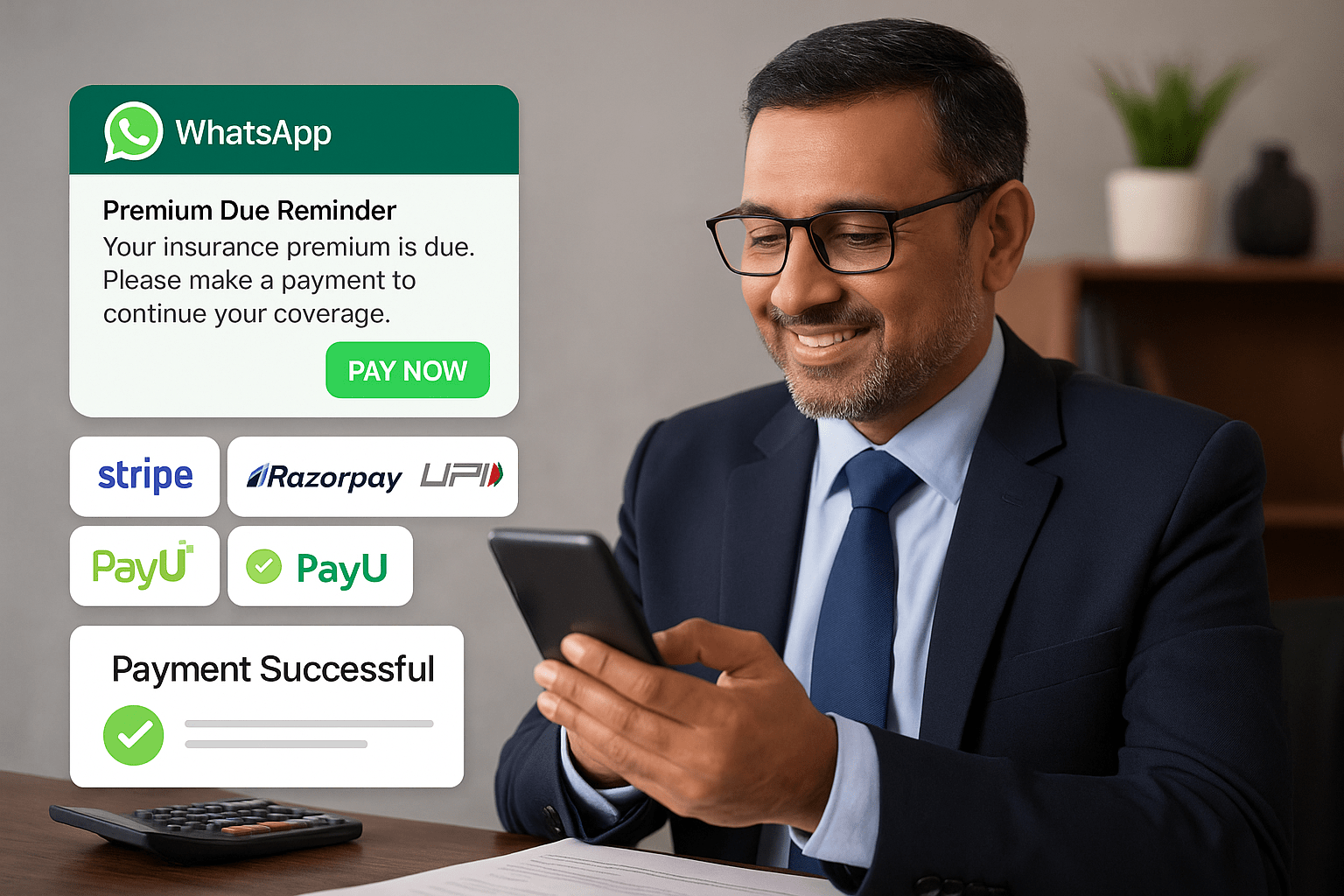

Insurance Premium Recovery: Reducing Policy Lapses

Case:

A mid-sized insurance provider struggled with late premium payments, leading to high policy lapse rates. Email reminders often went unread, and phone calls were time-consuming for the team.

Solution:

The company implemented WhatZCRM to send automated WhatsApp premium reminders with secure payment links via Razorpay and Stripe. Reminders were scheduled 7 days, 3 days, and 1 day before due dates, with instant receipts sent after payment. Clients were segmented by policy type for targeted messaging.

Result:

✅ 42% increase in on-time premium payments

✅ 28% reduction in policy lapses within 2 months

Loan EMI Follow-Up Automation: Reducing Defaults

Case:

An NBFC managing personal loans faced rising EMI defaults due to inconsistent follow-ups and manual tracking.

Solution:

WhatZCRM was used to automate EMI reminders, overdue notices, and payment confirmation messages on WhatsApp. Clients received a detailed breakdown of their EMI amount, due date, and a one-click payment link. CRM tagging allowed the team to monitor payment statuses in real time.

Result:

✅ 35% reduction in overdue EMIs

✅ 50% improvement in repayment rate for high-risk customers

Investment Portfolio Updates: Enhanced Client Engagement

Case:

A wealth management firm needed a faster, more personalized way to share portfolio performance updates with high-net-worth clients. Email reports were often delayed and had low engagement.

Solution:

Using WhatZCRM, the firm scheduled quarterly portfolio summaries via WhatsApp, including performance charts and downloadable PDF statements. Advisors could also follow up directly in the same chat thread for questions or meetings.

Result:

✅ 75% open rate for portfolio updates

✅ 60% faster client response time for investment discussions

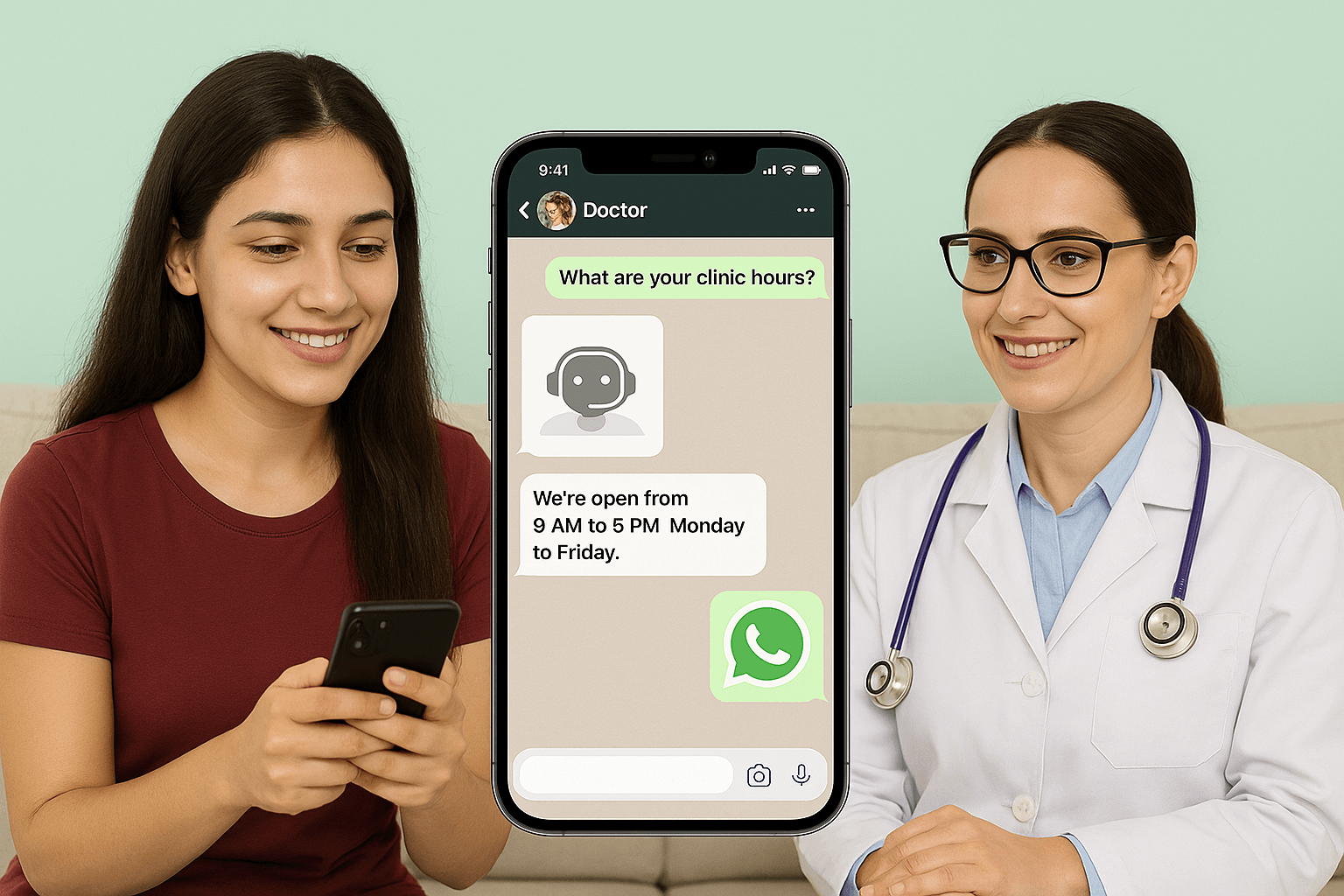

Insurance Claims Processing: Faster Settlements

Case:

A general insurance company experienced long claim settlement times due to delayed document submissions and lack of real-time updates to customers.

Solution:

WhatZCRM automated the claims process, allowing clients to submit documents (ID proofs, medical bills, claim forms) directly via WhatsApp. Status updates were sent automatically at each stage: submission received, under review, approved, and settled.

Result:

✅ Claim settlement time reduced from 5 days to 2 days

✅ 90% customer satisfaction score for claims communication

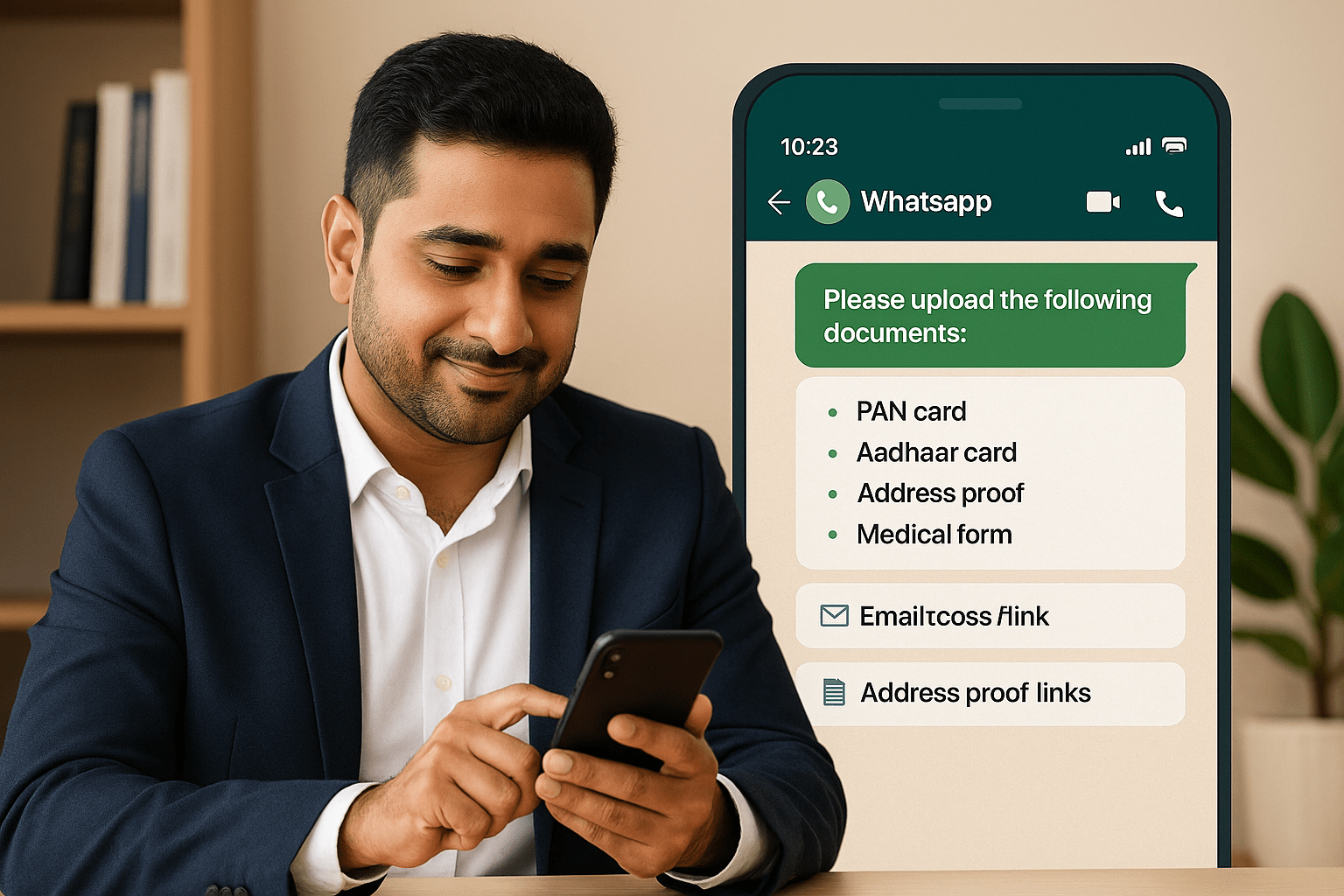

KYC Document Collection: Faster Loan Approvals

Case:

A microfinance institution faced delays in loan disbursement due to incomplete KYC submissions from rural customers.

Solution:

With WhatZCRM, loan officers could send WhatsApp KYC requests in local languages, allowing customers to upload PAN, Aadhaar, and address proof securely via chat. Automatic reminders were sent if documents weren't received within 48 hours.

Result:

✅ 55% faster KYC completion rate

✅ Loan approval time reduced by 3 days