In today’s digital era, insurance providers are discovering new ways to connect with their customers. Traditional methods such as phone calls and emails are no longer sufficient to meet policyholders’ expectations for instant, personalized communication. This is where WhatsApp CRM comes into play. WhatsApp CRM for Insurance has emerged as a game-changing solution for insurance businesses to manage leads, sales, and customer support directly through WhatsApp.

WhatsApp CRM for Insurance is a customer relationship management system that integrates WhatsApp Business with CRM tools to help insurance providers manage leads, automate sales follow-ups, handle claims support, and deliver personalized customer communication from a single platform.

Table of Contents

ToggleWhat is WhatsApp CRM?

WhatsApp CRM combines the power of WhatsApp Business with advanced Customer Relationship Management (CRM) WhatsApp CRM features for insurance. Unlike standard WhatsApp communication, WhatsApp CRM allows insurance providers to centralize customer interactions, automate routine tasks, and track leads and sales performance. For insurance agents, this means less manual work, faster responses, and better management of policyholder relationships.

Why Insurance Businesses Choose WhatsApp CRM

Insurance businesses face unique challenges, including delayed responses to inquiries, missed leads, and fragmented communication across teams. WhatsApp CRM solves these problems by providing a centralized platform to manage customer interactions.

Some key reasons insurance providers are choosing WhatsApp CRM include:

- Instant Lead Engagement: WhatsApp CRM ensures that no inquiry goes unanswered, helping agents convert leads faster.

- Automation for Routine Tasks: Chatbots and automated workflows handle repetitive tasks like follow-ups, reminders, and policy updates.

- Improved Customer Experience: Policyholders receive timely responses, personalized messages, and seamless support.

- Team Collaboration: Multiple agents can manage conversations efficiently through a unified inbox.

- Analytics and Insights: Businesses can monitor agent performance, response times, and sales metrics for informed decision-making.

By addressing these critical pain points, WhatsApp CRM enables insurance businesses to stay competitive and deliver exceptional service.

Also Read: What Is a WhatsApp CRM, and Why Businesses Need It

Key Features of WhatZCRM for Insurance Providers

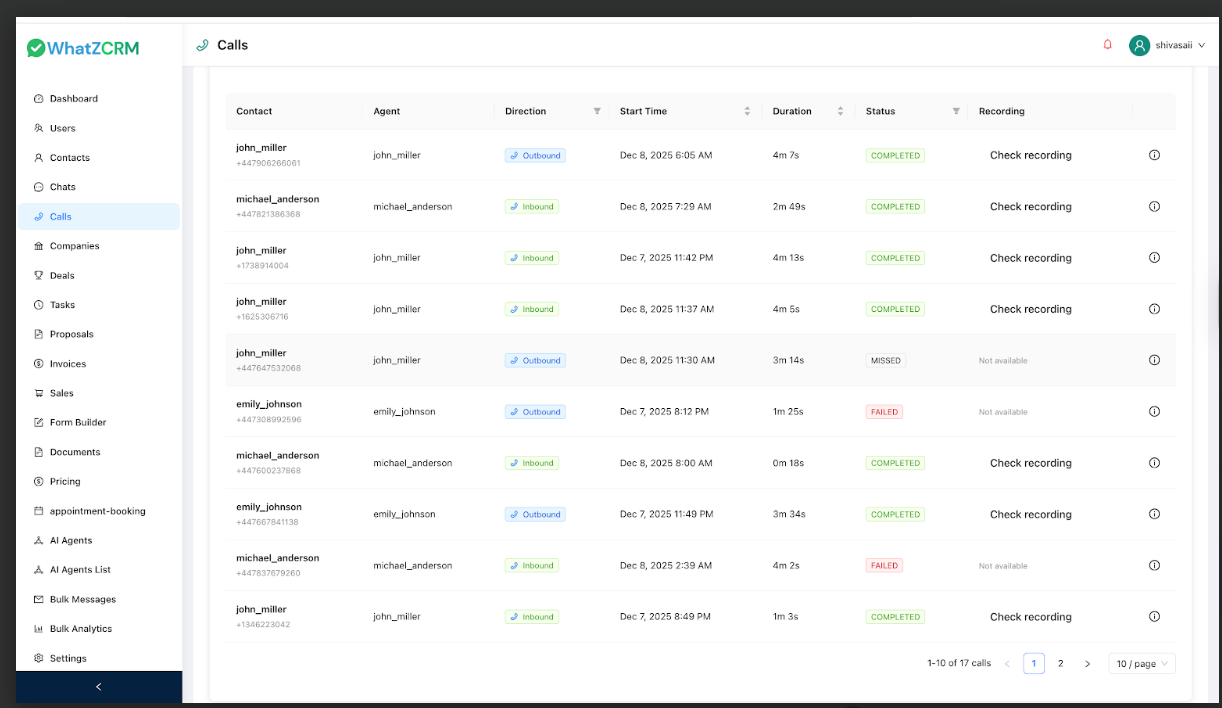

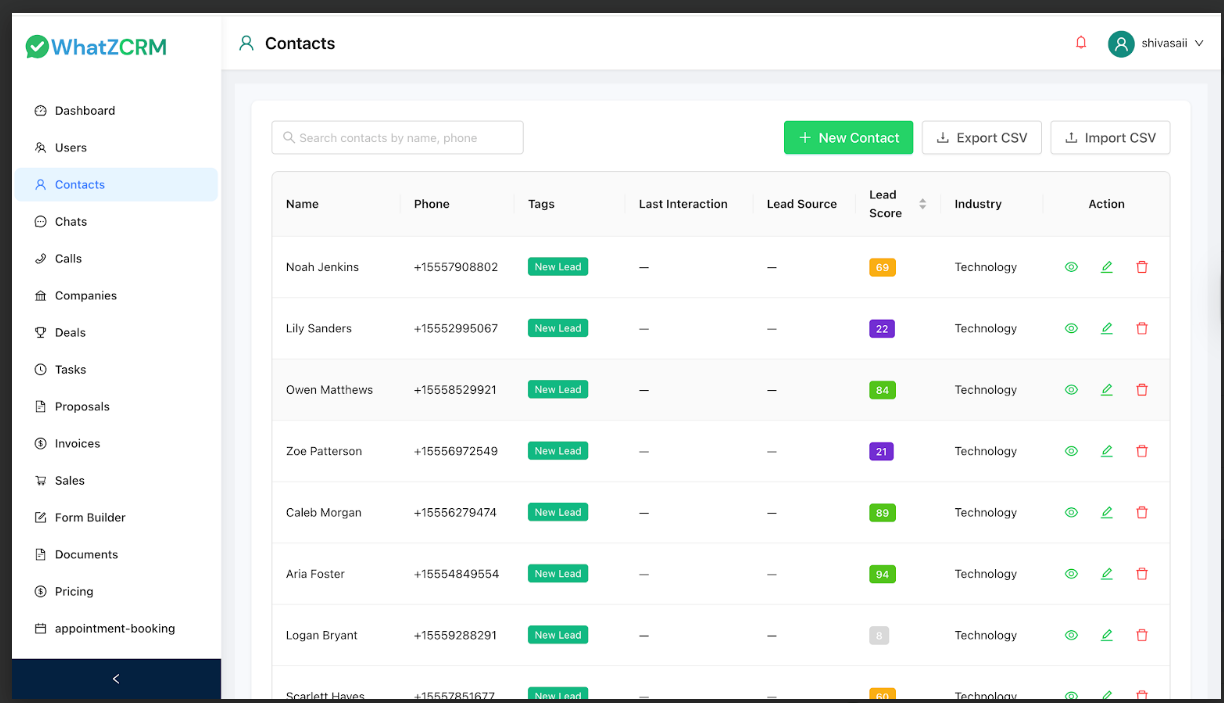

Insurance providers can leverage WhatZCRM to improve both sales and customer support. Key features include:

- Centralized WhatsApp Inbox: Manage all customer conversations from multiple WhatsApp numbers in a single dashboard, ensuring no lead is missed.

- Multi-Agent & Multi-Department Support: Assign leads and queries to the right agents or departments for faster resolution.

- Automation & AI Chatbots: Auto-replies, follow-ups, reminders, and AI-powered chatbots handle claims support, policy queries, and common FAQs efficiently.

- Contextual Client Communication: Maintain personalized conversations by tracking customer history, interactions, and policy details.

- Proposal and Document Sharing with E-Signatures: Send policy proposals, documents, and contracts digitally, and get e-signatures directly via WhatsApp for faster closures.

- Targeted Campaigns and Cross-Selling Opportunities: Segment customers and run campaigns to promote renewals, add-ons, or new policy options.

- Lead Management & Segmentation: Tag, score, and segment leads based on policy type, stage, and engagement.

- Sales Pipeline & Task Management: Track leads across stages, generate quotations, schedule appointments, and manage team tasks efficiently.

- Broadcast & Campaign Automation: Send policy updates, renewal reminders, or promotional campaigns to targeted segments.

- Analytics & Reporting: Monitor agent performance, response time, lead conversion, and overall sales performance.

These features make WhatZCRM the ideal WhatsApp CRM solution for insurance providers who want to streamline operations, increase lead conversion, and enhance customer satisfaction.

How WhatsApp CRM Improves Insurance Sales

How to Increase Insurance sales often requires multiple touchpoints before a lead converts. WhatsApp CRM accelerates this process by:

- Reducing manual follow-ups through automated reminders and sequences.

- Ensuring leads receive instant responses increases the chance of conversion.

- Providing insights on which strategies and communications are most effective.

- Enabling cross-selling and upselling through targeted campaigns.

How WhatsApp CRM Enhances Customer Support in Insurance

Customer support is crucial for insurance businesses. WhatsApp CRM enhances support by:

- Providing instant updates on policy status, claims, and renewals.

- Offering 24/7 assistance via AI-powered chatbots for claims and common queries.

- Allowing agents to personalize interactions using customer history and tagging features.

- Sharing proposals and documents securely with e-signatures for policy approvals.

Best Practices for Insurance Providers Using WhatsApp CRM

To maximize the benefits of WhatsApp CRM, insurance businesses should:

- Segment customers based on policy type and engagement behavior.

- Balance WhatsApp automation with personal communication for complex inquiries.

- Regularly analyze metrics to optimize workflows and customer engagement strategies.

- Ensure compliance with privacy regulations when sharing sensitive policy information.

Choosing the Right WhatsApp CRM for Your Insurance Business

Selecting the Best WhatsApp CRM for insurance companies can make a significant difference. Consider:

- Essential features include multi-agent inbox, automation, AI chatbots, proposal sharing, sales pipeline management, and analytics.

- Integration capabilities with your existing systems and software.

- Scalability to support future growth and increasing customer volumes.

- Reliable customer support from the CRM provider.

Conclusion

WhatsApp CRM is transforming the way insurance providers manage sales and customer support. By automating routine tasks, centralizing communication, and providing actionable insights, insurance businesses can boost lead conversion, improve customer satisfaction, and enhance operational efficiency.

For insurance providers looking to streamline their processes, offer personalized service, and close policies faster, adopting a WhatsApp CRM solution like WhatZCRM is the key to staying ahead in a competitive market.

Frequently Asked Questions (FAQs)

It is a system that uses WhatsApp to efficiently manage insurance leads, sales, claims, and customer support.

It enables instant lead engagement, automated follow-ups, targeted campaigns, and cross-selling opportunities.

Features include multi-agent inbox, AI chatbots, automation, client communication, e-signatures, campaigns, lead management, and analytics.

Yes, AI chatbots provide instant support, and agents efficiently manage complex queries.

Agents can securely share proposals and policies, and customers can e-sign documents.

It centralizes communication, automates tasks, tracks leads, and provides analytics for better efficiency.

It enables customer segmentation and sends personalized messages, renewal reminders, and policy recommendations.

Yes, AI chatbots automate claims queries while agents handle complex cases.